Some of us may find it odd that the UK is now a member of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), given that the UK is nowhere near the Pacific Ocean. But strategic and economic opportunity trumps geography in this case, as there is an advantage to having a seat at the table in one of the fastest-growing regions in the world.

We looked at the potential impact of this deal across UK regions to find out who should be getting on the plane for the Pacific, and who might be better spending their resources elsewhere.

The data for our analysis comes from the Department for Business and Trade impact assessment of the UK’s accession to the CPTTP. The benefits derive mainly from a reduction in tariff barriers that make it easier and cheaper for UK firms to export goods or services and to a lesser degree the importing of materials for production (see here for a full explanation of the methodology).

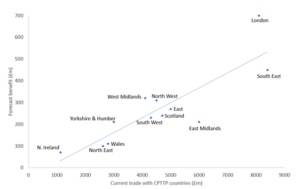

As the diagram below shows, there is an unsurprisingly strong relationship between the current level of trade with CPTTP countries and the forecast benefit. The outlier below is London which derives significantly more benefit than other regions in large part thanks to its role at the heart of UK service exports (London accounts for 48% of all UK services exports).

Figure 1: Forecast benefit for UK regions compared to their current trade with CPTTP region

Digging deeper to find the opportunity

This high-level analysis shows that the higher your volume of trade with CPTTP countries the more you are likely to benefit in the future. But what if you decided to take the advice of Business Secretary Kemi Badenoch and utilise the agreement to find its full potential?

Would it be worth investing your resources to develop closer relationships with CPTTP countries to get even more out of the deal?

The answer to that question starts with understanding your economy, as certain sectors benefit more than others from this deal. For example, areas with strong automotive and textiles manufacturing can expect more benefits than areas dependent on sectors such as electronic equipment and other transport that are more at risk of import competition.

One way to understand the potential at a local level is to look at the forecasted increase relative to your existing trade. This provides an idea of your potential ‘uplift’ from the deal and the extent to which even more trade would have a more positive benefit. For example, if you are currently forecast to see an above-average benefit from the deal (above the line in figure 1), then increasing your level of engagement with the CPTTP could reap above-average rewards – but by how much?

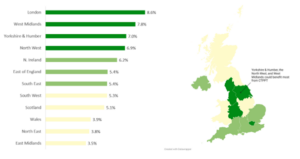

Our ‘uplift’ percentages are shown below.

Figure 2: forecast increase in regional trade as a percentage of existing trade

Looking at the data this way you would say that locations in London, the West Midlands, Yorkshire and Humber, and the North-West are likely to get the biggest uplift in trade from the CPTTP. So, investing more resources in developing relationships could return higher rewards.

Wales, the North East, and East Midlands do not benefit as much from the deal relative to their existing trade, so you could argue that economic development resources might be better spent in areas more suited to local strengths under pressure.

One other dimension to consider is linked to one of the reasons why the UK joined the CTPPT in the first place, the possible expansion of the trading bloc. Costa Rica and Ecuador have applied to join, while Uruguay, Thailand, the Philippines, and South Korea have also expressed an interest. And two real game changers in China and the US have both flirted with the possibility. Understanding the fit between your regional economy and these new entrants could change your potential benefits and strategy.

Find out how you could benefit

There are limitations to this research as regional trade is notoriously difficult to assign and there is always a degree of uncertainty about future forecasts across multiple countries and sectors. However, the analysis provides a general picture of which regions are likely to benefit most.

OCO Global have worked with multiple regional and local agencies across the world to model future trade impacts and provide detailed and specific results for clients. Our recommendation would be for anyone interested in understanding the potential of CPTTP to map their economic strengths, analyse their trade data at a sectoral level, understand future market dynamics in CPTTP countries, and consider the impact of new entrants to the trading bloc.

If you would like to learn more about how we can help with such analysis, then get in touch by clicking HERE